Updated January 11, 2023

Reading Time: 5 minutes

From Buyer Beware to Seller Beware

Ten years ago how customers researched and purchased goods looked very different. Typically brands controlled the information and steps within the sales process. Many companies also relied upon brand loyalty that fueled repeat purchases. Now, with the proliferation of smartphones, ease of online search, and changing consumer attitudes, the power is firmly in the hands of the buyer (caveat venditor). As online shopping continues to grow will customer loyalty die out?

Digital Disruption

Digital disruption is leading to an unprecedented erosion of brand loyalty across key industries.” It’s no surprise that customers are taking advantage of digital channels as they research products and share experiences. Poorly designed websites, underwhelming service experiences, and negative reviews fuel customer churn. In their research, Accenture describes this new shopper as the “non-stop customer.” Consumers are alert to new options, seeking and seizing opportunities, caring very little about who or where they are purchasing from.

What are the industries at greatest risk for digital disruption? Traditional companies in the retail, banking, and telecommunications who are slow to respond to these emerging customer behaviors. Banking, for example, is an industry that has had to adapt to change in recent years. Not long ago your bank would stay your bank for your lifetime. But now switching banks to get a better interest rate, or for other benefits, is becoming more and more commonplace. Shopping around is not just something you do for electrical goods anymore.

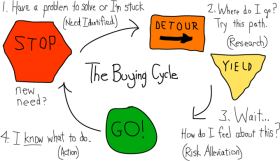

The Sales Journey Is No Longer Linear

Brands are used to the traditional sales funnel, where they control the information that guides a prospect toward a buying decision. Now that process is controlled by the consumer, the sales journey is no longer linear. And that process is accelerated by the ability to view and interact with content across multiple channels. The Accenture report found the following:

- 88% of consumers use at least one digital channel while looking for products and services — this is up 78% from five years ago.

- 40% of consumers want more digital interactions than what companies are actually providing.

- There’s a growing population of customers who seek digital-only forms of interaction

Factors Affecting Customer Loyalty

In Inc.’s article Brand Loyalty Is (Almost) Dead, Contributing Editor Geoffrey James claims that “the Web weakens and destroys brand loyalty in two ways.”

- First is the ready availability of user review and competitor information. As such, “buyers no longer need a brand as a guarantor of quality.”

- Second is the perceived sameness due to outsourcing supply chains. Consumers see products as “pretty much the same regardless of whose brand has been stuck on them.”

Let’s look at Accenture’s 2020 research. They cite eight main reasons why brands lose customers:

- Customers are keeping an eye open for something new and are buying less from current providers

- Relying upon a first-contact experience that needs improvement

- Failure to capitalize on their website and other channels to make it easy for customers to prospect

- Barriers in digital service channels that customers want

- Customer service expectations are rising faster than companies provide

- Customer loyalty programs aren’t enough to prevent customers from switching

- Lack of compelling offers for winning back customers

- Non-traditional competitors gaining ground with customer base

Additional Buying Behavior Statistics

In 2014, PriceWaterhouseCooper conducted 7,000 online consumer interviews. Respondents across three continents were chosen to reflect the national profile in terms of age, gender, employment status and region. Their analysis noted that:

- Only 32% of online shoppers followed brands through social media

- 49% of customers don’t tell a retailer about their bad experiences

- 69% of consumers will share their bad experiences with others in a month

- Bad experiences linger 1.2 times longer than good ones

Additional PwC research found that the role of the physical store is changing. Stores serve two distinct purposes: 1) as a showroom where customers come for inspiration and to interact with products, and 2) as a transaction point to complete a journey started on the web or to seek service for products bought regardless of the purchase channel.

Boomers: A Traditionally Loyal Demographic & Their Buying Behavior

Immersion Active, a firm specializing in age-based marketing strategies, researched online buying behaviors for Baby Boomers, GenX and Millenials. Brands who target GenX and Millennials know they must have a strong digital marketing strategy. You might think there’s less pressure on brands whose main audience is older. Nope.

In fact, Baby Boomers are very comfortable browsing and shopping online. 85% reported they research products online and 66% of people over 50 routinely make online purchases from retailers. They also love coupons and sales — 75% are more likely to purchase if they have a coupon or loyalty discount. The ease of shopping around allows them to bargain hunt at their leisure.

GenX is known for being a skeptical generation. Can they be loyal customers? Yes, nearly half of GenX internet users polled by CrowdTwist characterized themselves as extremely or quite loyal to favorite brands.

Dying a Not-So-Slow Death?

In her July 2016 Forbes article, Kathleen Kusek is ringing the death knell of brand loyalty. She’s worked on marketing strategies for such notable brands like Genentech, Four Seasons Hotel, and Pioneer Electronics. Here’s what she says about brand or customer loyalty:

- Consumers are not inclined to be loyal as generational experiences have shaped them. By remaining loyal it means not exploring alternatives and thus missing out.

- Major trends in marriage, religion, politics, and corporate America have reframed our expectations about surviving and thriving in the world.

- Change is something we no longer avoid but embrace. And, our need for change is increasing at an accelerated pace.

Customer Loyalty & Price Sensitivity

In a 2013 article by MarketingProfs, an industry leader for marketing training and resources, examined a U.S. consumer survey conducted by Parago. The report found:

- 74% of shoppers are more sensitive to price than they were the previous year

- 80% of consumers look for deals, rebates and the best prices (up from 69%)

- 46% used their smartphone to check prices

- Price was the most important driver for every income level below $200,000

Ok, we expect price sensitivity for many products that we purchase on a regular basis. But what about luxury goods?

According to Luxury Daily, they explored the gap between ecommerce and brand experience. Citing research from Salesfloor’s 2016 Omnichannel Retail Associate Study, 58% of consumers feel that online shopping lacks the personalized attention they would receive when visiting a physical store. Alrighty, that makes sense. However as the “customer journey becomes more convoluted, luxury brands can no longer afford to view the online and in-store experiences as separate entities. Luxury Daily also quotes McKinsey & Co; they anticipate that the luxury sector will triple their online sales in the next decade. It’s not a surprise that ecommerce needs to be a part of that strategy.

Does Customer Loyalty Have a Heartbeat?

We know that purchasing behavior has drastically changed in the last twenty years; we’re now dependent upon search engines and the web for information. It’s not uncommon for our research — regardless of demographics — to bridge across devices. Our appetite for multiple touchpoints on various channels continues to grow. Our fear of missing out — even at the expense of long-term relationships with brands that we know and trust — drives us to explore alternatives.

So does customer loyalty have a heartbeat?

Maybe a faint one. Brands that rely upon what’s worked in the past will continue to fall behind. I suspect that customer loyalty will continue to morph into something else entirely. Gone are the days of traditional and unwavering loyalty. How we measure satisfaction and retention must change because our customers are demanding it.

Interviewing An SEO Company

Interviewing An SEO Company